Risk Management: The Key to a Confident Retirement

At Stonebrook Capital Management, risk management isn’t just part of our investment process — it’s the foundation of it. Our goal is to help you grow your wealth while protecting what you’ve already worked so hard to build.

Why Risk Management Matters — Especially in Retirement

For retirees and pre-retirees, the stakes are high. You’ve saved diligently. You’re approaching or living in retirement. But one thing can derail even the best-laid plans: market losses early in retirement.

This is known as sequence of returns risk — the danger that a market downturn in the early years of retirement can permanently reduce your income and deplete your portfolio. Unlike in your working years, you don’t have the luxury of simply “waiting it out.” You need a plan that works through all market cycles.

That’s where risk management comes in.

Our Philosophy: Manage the Risk, Unlock the Freedom

We believe that managing downside risk is the best way to unlock confidence, peace of mind, and freedom in retirement. It allows you to live your life — travel, spend time with family, pursue passions — without constantly worrying about your portfolio.

Think of it like this:

If your investment plan is a car, risk management is the speed limit.

We want to get you to your destination — your ideal retirement — as quickly and efficiently as possible, but get you there safely. Setting the right "speed" for your portfolio helps prevent panic, emotional decisions, and keeps you on track.

How We Manage Risk

We use data, technology, and experience to align your portfolio with your goals and risk tolerance.

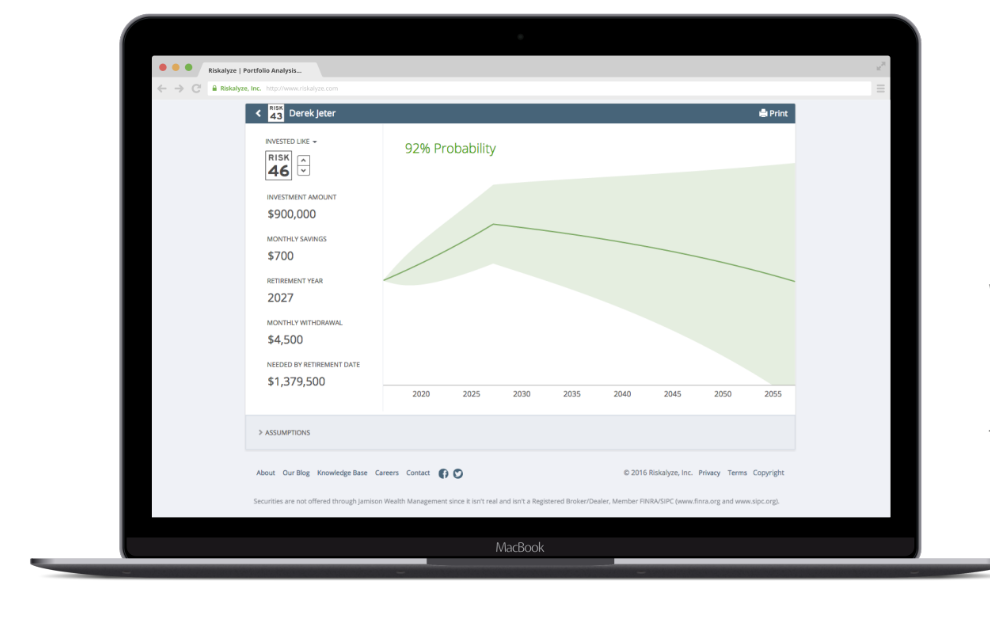

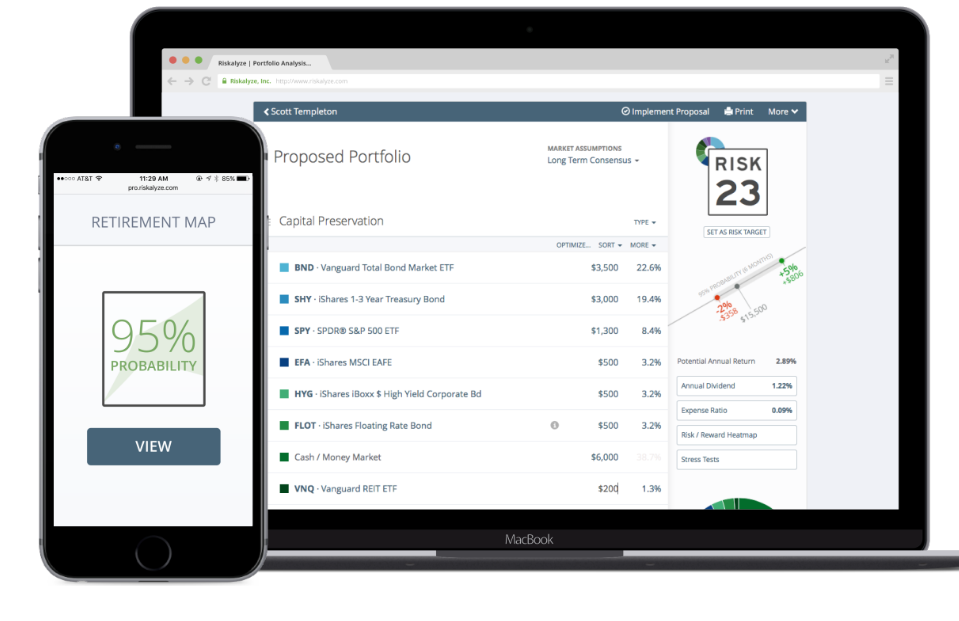

We use Riskalyze® to:

- Measure your true risk tolerance — not just with a questionnaire, but with real-world scenarios.

- Stress-test your current portfolio to see how it might perform in different markets.

- Align your investments with your comfort zone — so you are never forced to make emotional decisions at the wrong time.

Your unique “Speed limit” is a guide to get you the best results possible for your level of risk:

- If investing conditions are good and markets are trending higher, we can safely drive above the speed limit.

- When market conditions worsen and visibility is poor, we make proactive adjustments to your portfolio designed to protect from big losses.

The Results: Confidence to Retire on Your Terms

Our clients tell us they feel:

- More peace of mind, knowing their plan accounts for market volatility

- Greater confidence, because they understand how much risk they're taking (and why)

- More freedom, because they can focus on enjoying retirement — not worrying about it

All investing involves risk. But with the right plan helps you navigate volatility, and thrive in spite of it.

Want to Know How Much Risk You’re Taking?

We offer a complimentary portfolio stress test and risk alignment review using Riskalyze.

Let’s find out if your investments match your goals — and whether you're driving at the right speed.